Table of Content

Be sure to shop around and compare rates before you decide on a lender. The downside, though, is that closing costs tend to be high on cash-out refinances, so make sure you have cash on hand to cover these. According to Freddie Mac, the average closing costs on a refinance are around $5,000. Instead of getting a credit line that you can use many times, home equity loans give you a one-time, lump-sum payment at closing.

There are also not-so-good reasons to draw from your equity, such as buying a car , paying for a wedding or taking a vacation. It’s important to get clear on your goals so you’re making a sound financial decision. Suzanne De Vita is the mortgage editor for Bankrate, focusing on mortgage and real estate topics for homebuyers, homeowners, investors and renters.

Equity Loan Requirements

We analyze over 27 million transactions and thousands of reviews to determine which agent is best for you based on your needs. There are also several reasons to buy a new house but keep your paid-off house. If you can afford to purchase another house but keep up with the taxes and utilities of the paid-off house, you have even more options.

If their home equity loan offers a lump sum of up to 85% of their equity, then they would be able to borrow up to $85,000. Although some homeowners use these funds to pay down their mortgage, they could also take out a home equity loan to cover other costs, such as remodeling their kitchen or paying for college. If you’re considering a cash-out refinance, SoFi might be an option. The online bank offers loans, credit cards, insurance, credit cards, and more. Using a home equity loan on a paid-off house allows you to tap into a significant amount of your equity since there are no other liens against the home. "Your home equity is more appealing to lenders since they know that you’ve already paid off a large loan," Pendergast said.

Cash-Out Refinance

On the other hand, one of the great advantages to using a home-equity loan to pay off credit card debt is the low interest rate afforded to these secured loans.Most home-equity loan rates are just. This number is the total monthly debt obligations divided by income. Lenders take this number and add the new potential equity mortgage payment to see if it remains in the low 40 percent range. Especially with bad credit, you need to prove you have plenty of income to cover expenses and the mortgage payment. Home equity loans use your house as collateral for the loan, just like your primary mortgage.

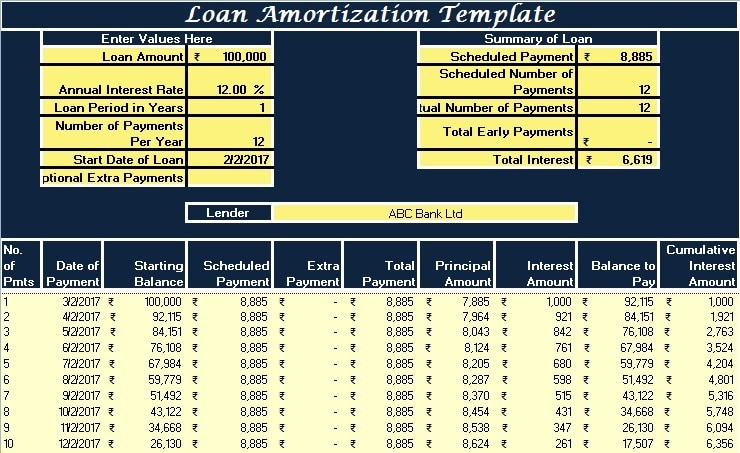

A home equity loan functions much like a mortgage where you’re provided a lump sum up at closing and then you begin repayment. Every month, you’ll make the same payment amount, which is a combined principal and interest payment, until your loan is paid off. In the first half of the loan, you’ll make interest-heavy payments and then principal-heavy payments in the second half — this is called amortization. Using these funds, the escrow agent repays the primary $400,000 mortgage and the $50,000 home equity loan, leaving you with a profit of $355,000 before closing costs of around 10%. Lars Peterson is a veteran personal finance writer and editor with broad experience covering personal finance, particularly credit cards, banking products, and mortgages. He has been writing and editing for more than 20 years and has a knack for digging deep into a subject so he can make it easier for others to understand.

How to get a home equity loan

Mortgages are typically taken when you purchase the home, allowing you to buy the home over an extended period of time. Mortgage durations are usually 15- or 30-year terms with fixed or adjustable rates. Owning the house outright means you made scheduled payments and have a zero loan balance. Home equity loans are sometimes called second mortgages since they operate in a very similar fashion.

Once your main mortgage is paid off, though, qualifying for a home equity loan is usually easier than ever. Expect to pay around 2% to 5% of the loan amount in closing costs. Using a paid-off house as collateral has both advantages and disadvantages. Consider these pros and cons before taking out a home equity loan.

Remember, though, that when you tap the equity in your home, you are essentially taking out a mortgage that is backed up by the value of your home. I have guaranteed $1000 a week income from a SMSF, which I can’t take. Here are a few of the key advantages and disadvantages of home equity loans. Carefully review disclosure documents and agree to the home equity loan terms. A home equity loan or home equity line of credit allows you to rely on equity from your house to fund a loan. You also have the option to refinance your home loan with a new loan.

For many people, it’s simply not the right time to move, or their current house is perfect for their current situation. With a HELOC, you receive a revolving line of credit instead of a lump-sum loan amount, where you can borrow money over time. Having a house totally paid off means you can tap the equity in it.

However, it can also cost you big if your home appreciates a lot over the course of your agreement's term. The total you're allowed to receive in cash may depend on your lender. As a general rule of thumb, you can't receive more than 80% of your home's value in cash.

Whether or not you should borrow against your paid-off house will be determined by your financial situation and why you need the money. Keep in mind that your overall debt will be factored into your debt-to-income ratio , which can affect your interest rate and eligibility for your new mortgage. These rates do not include interest payments, which are an important factor in how much you pay each month. You put down $30,000 when you bought it and since then, you have paid $30,000 in mortgage principal.