Table of Content

- Pros and cons of tapping equity on a paid-off house

- Should You Use Home Equity To Pay Off Your Mortgage?

- Equity Loans vs. Mortgage Loans

- Mortgages

- Home Equity Loan On Paid Off House

- How rising mortgage rates affect home equity loans

- Thinking about buying but not sure where to begin? Start with our affordability calculator.

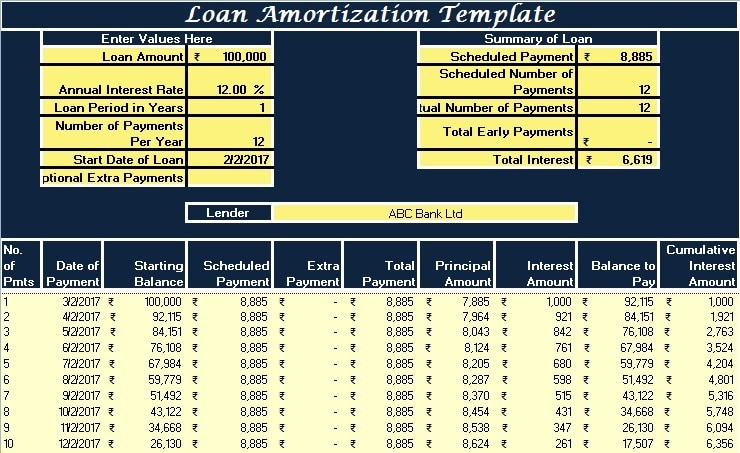

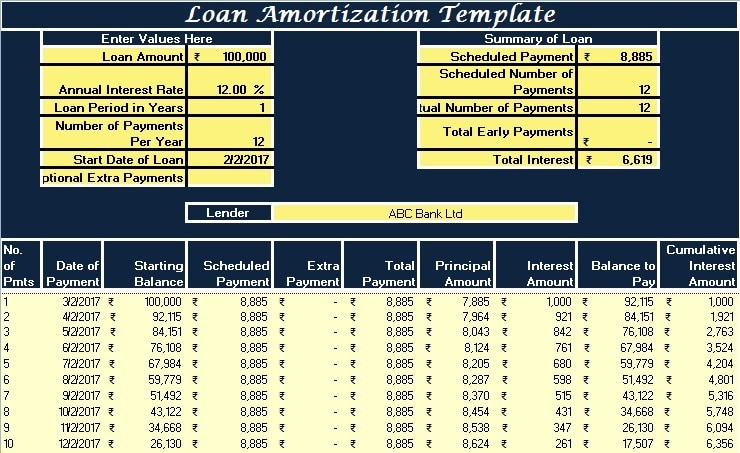

The loan amount is based on the value of the home, minus the mortgage balance. Owning your home in full can make it easy to access cash when you need it without having to sell your house or pay sky-high interest rates like you would on a credit card. When you borrow against a house that is paid off, you’re introducing a financial risk that didn’t exist before. Regardless of the loan product you choose, you’ll be exposing your home to the possibility of foreclosure if you’re unable to afford the payments. Home equity loans typically have fixed rates, so you’ll have a steady interest rate and predictable payment for the life of the loan. Most lenders won’t care, for instance, if the money will be put toward funding retirement, seeding a new business or making a down payment on an investment property.

Equity is basically the difference between what you owe your lender and what your home is worth. The difference between the amount of mortgage loan owed and the value of your home is the equity in a house. For example, if the amount of outstanding balance you owe on your mortgage loan is $130,000 and the value of your house is $180,000, the equity is $50,000. With this equity, you can take out different types of loans such as equity loans, lines of credit, a reverse mortgage, cash-out refinance loans or take an additional mortgage. Home equity loan interest rates are almost always fixed, which means they’re stable throughout the life of your loan.

Pros and cons of tapping equity on a paid-off house

Let us give an example of home equity that illustrates it more clearly. The mortgage lender then offers a mortgage loan for the amount of $180,000. To calculate your home equity, you need to know the value of your home and the current mortgage balance, which is written on the monthly statement. Then, you need to subtract the current mortgage balance you owe from your home’s market value.

HELOCs in particular are designed to offer maximum flexibility, particularly during their initial draw period. Mortgages and second mortgages can typically also be repaid early, although they may be subject to prepayment rules and penalties. A home equity loan can be a great way to get the money you need for a variety of purposes, including home improvements, debt consolidation, or even investing in a second property. However, it’s important to understand that taking out a home equity loan will put your home at risk if you default on the loan.

Should You Use Home Equity To Pay Off Your Mortgage?

If you don’t have a current mortgage, you can still do a cash-out refinance—and it might even mean a lower interest rate than other financing options can provide. Figure is a great option if you’re looking for an online lender that can get you your funds quickly. You have no obligation to use your total line of credit, and the funds can be used however you’d like. Your credit history and other financial information affect your mortgage rate on a mortgage or home equity loan.

This is an advantage over non-home equity products such as personal loans or credit cards. Review and compare the loans to determine which lender has the best terms. In addition to the interest rate and monthly payment, compare the annual percentage rate , length of the loan, total interest paid and loan fees.

Equity Loans vs. Mortgage Loans

Get rid of debts one by one and make a commitment to pay on time to build your credit back up. When you have plenty of equity, selling a home with a home equity loan isn’t a big deal. If you don’t have much home equity or you’re upside-down in your mortgage, you may be challenged.

While you deal with the debt, use any remaining credit you have responsibly. Use credit cards only for monthly necessities and pay them off every month. Take the time to get the credit score closer to what lenders prefer.

Mortgages

They’re using the $400,000 in profits to support them in their retirement. At HomeLight, our vision is a world where every real estate transaction is simple, certain, and satisfying. Therefore, we promote stricteditorial integrity in each of our posts. Among the benefits of doing so are that you can consolidate high interest rate debts or use the money to invest. To acquire a home equity loan it takes between two and six weeks from application to close, compared to four to six weeks for most other loan closings. Most lenders will allow you to borrow up to 80% LTV, but some will let you go as high as 90%.

You may feel better about signing a longer contract with lower payments if there is no penalty for an early payoff. When you’re ready to make your final payment on your home equity loan, call your lender. Only they can give you the correct final payment amount based on how much interest has accrued in that payment cycle. A cash-out refinance is a mortgage refinancing option that lets you convert home equity into cash. Your home is collateral for the loan, which allows the interest rate to be much lower than a credit card or unsecured line of credit.

Unlike with a home equity loan, a HELOC won’t give you a lump sum of cash upfront. You only borrow what you need , which is convenient because you don’t have to pay interest on the remaining funds you don’t use. You can choose to use the home equity loan to pay off your mortgage loan—if you have enough equity to afford that, and if the home equity loan has a lower interest rate than your mortgage.

"If your home is paid off, you can apply for a home equity loan without much hassle. Repayment of a home equity loan takes anywhere from five to 30 years, but the most common home equity loan term is 20 years. Talk to your lender to decide on a repayment term that works best for you. Even someone who has experienced bankruptcy can rebuild credit scores to over 600 in three or four years. If your score is in the truly bad range, review the items on the report that are bringing your score down. Look for any errors on credit items you satisfied, and petition the company and credit reporting agency to remove the error.

One of the easier ways to do this is to sell your home, but there are also financial products that allow you to extract equity from your paid-off home quickly without having to pick up and move. At Bankrate we strive to help you make smarter financial decisions. While we adhere to stricteditorial integrity, this post may contain references to products from our partners.

"Mortgages are also secured loans, which means the owner can potentially lose the home in foreclosure if they stop making payments." Keep in mind that each lender charges different amounts for home equity loan fees, and some lump multiple types of fees together. Some lenders even offer no closing cost home equity loans, which prevent upfront costs but can result in a higher interest rate for the life of the loan. Closing costs range between 2% and 5% of the loan amount, which is typically lower than closing costs on a purchase mortgage and even slightly lower than closing costs on a cash-out refinance.

How rising mortgage rates affect home equity loans

You’ll also pay a loan origination fee that’s a percentage of the total amount you’re borrowing. Liens are legal notices attached to your home when you owe a creditor money. For example, suppose you owe money to the Internal Revenue Service . In that case, you may need to satisfy the tax lien using your equity before finalizing any sale or refinancing your home. You can use your equity to pay off your mortgage through a home equity line of credit , a home equity loan, or by refinancing.

Metro area, Erika enjoys painting her furniture too many times and finding the prettiest townhouses to walk by. Home equity loans are a type of second mortgage that let you turn your home equity — or the portion of the home you actually own — into cash. She does management consulting for finance and accounting for businesses, utilizing her years of experience in public and private industry in financial planning & analysis and accounting. She does one-on-one coaching for personal finances with a five-week program she developed to help people learn to manage money and experience financial freedom and success. She created a financial planner to view money spending habits, track your finances, and write out your goals. Before tapping into your home equity, consider all the options carefully and fully understand the terms and conditions for each.

No comments:

Post a Comment